- 77.00 KB

- 7页

- 1、本文档共5页,可阅读全部内容。

- 2、本文档由网友投稿或网络整理,如有侵权请及时联系我们处理。

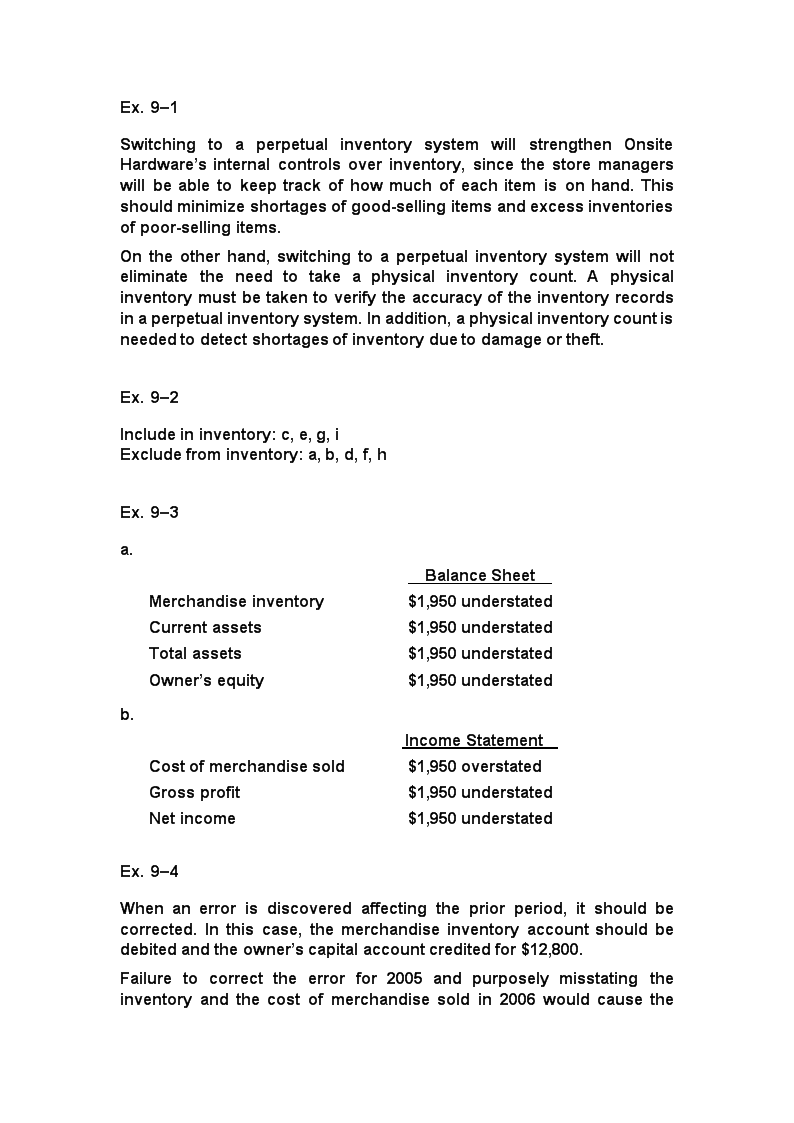

'Ex.9–1SwitchingtoaperpetualinventorysystemwillstrengthenOnsiteHardware’sinternalcontrolsoverinventory,sincethestoremanagerswillbeabletokeeptrackofhowmuchofeachitemisonhand.Thisshouldminimizeshortagesofgood-sellingitemsandexcessinventoriesofpoor-sellingitems.Ontheotherhand,switchingtoaperpetualinventorysystemwillnoteliminatetheneedtotakeaphysicalinventorycount.Aphysicalinventorymustbetakentoverifytheaccuracyoftheinventoryrecordsinaperpetualinventorysystem.Inaddition,aphysicalinventorycountisneededtodetectshortagesofinventoryduetodamageortheft.Ex.9–2Includeininventory:c,e,g,iExcludefrominventory:a,b,d,f,hEx.9–3a.BalanceSheetMerchandiseinventory$1,950understatedCurrentassets$1,950understatedTotalassets$1,950understatedOwner’sequity$1,950understatedb.IncomeStatementCostofmerchandisesold$1,950overstatedGrossprofit$1,950understatedNetincome$1,950understatedEx.9–4Whenanerrorisdiscoveredaffectingthepriorperiod,itshouldbecorrected.Inthiscase,themerchandiseinventoryaccountshouldbedebitedandtheowner’scapitalaccountcreditedfor$12,800.Failuretocorrecttheerrorfor2005andpurposelymisstatingtheinventoryandthecostofmerchandisesoldin2006wouldcausethe

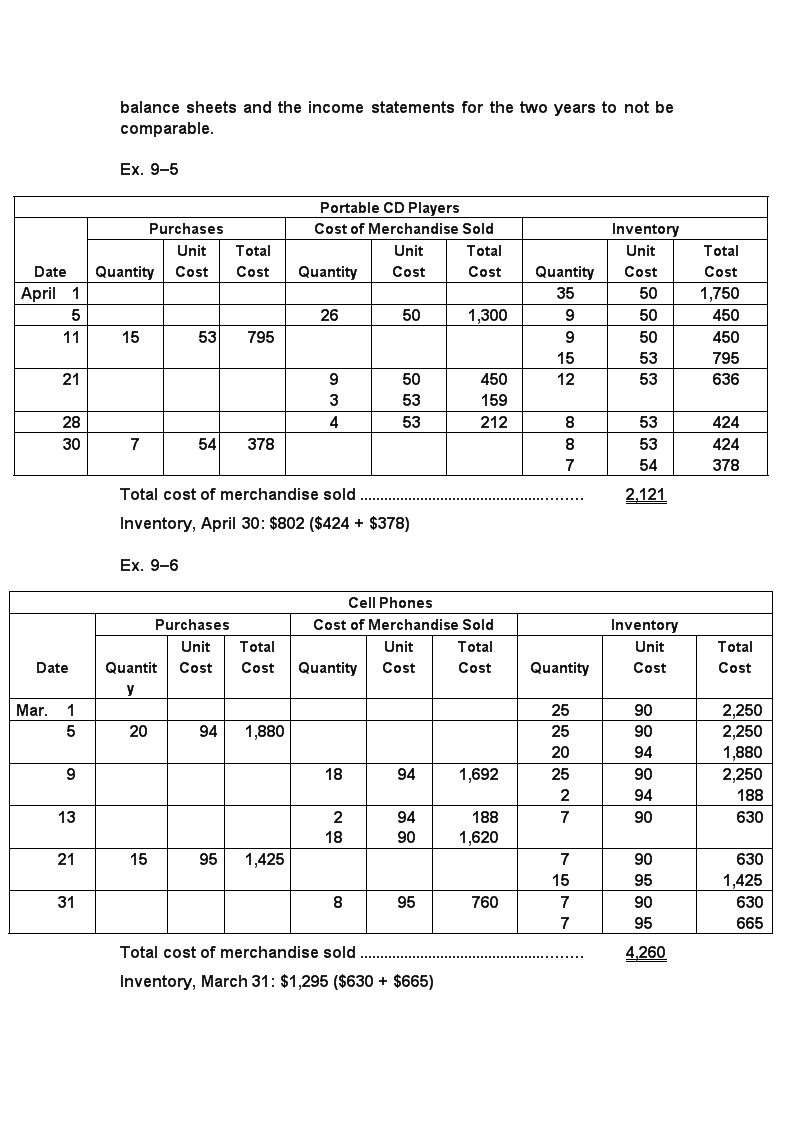

balancesheetsandtheincomestatementsforthetwoyearstonotbecomparable.Ex.9–5PortableCDPlayersPurchasesCostofMerchandiseSoldInventoryDateQuantityUnitCostTotalCostQuantityUnitCostTotalCostQuantityUnitCostTotalCostApril135501,750526501,30095045011155379591550534507952193505345015912536362845321285342430754378875354424378Totalcostofmerchandisesold2,121Inventory,April30:$802($424+$378)Ex.9–6CellPhonesPurchasesCostofMerchandiseSoldInventoryDateQuantityUnitCostTotalCostQuantityUnitCostTotalCostQuantityUnitCostTotalCostMar.125902,250520941,880252090942,2501,880918941,69225290942,2501881321894901881,6207906302115951,42571590956301,42531895760779095630665Totalcostofmerchandisesold4,260Inventory,March31:$1,295($630+$665)

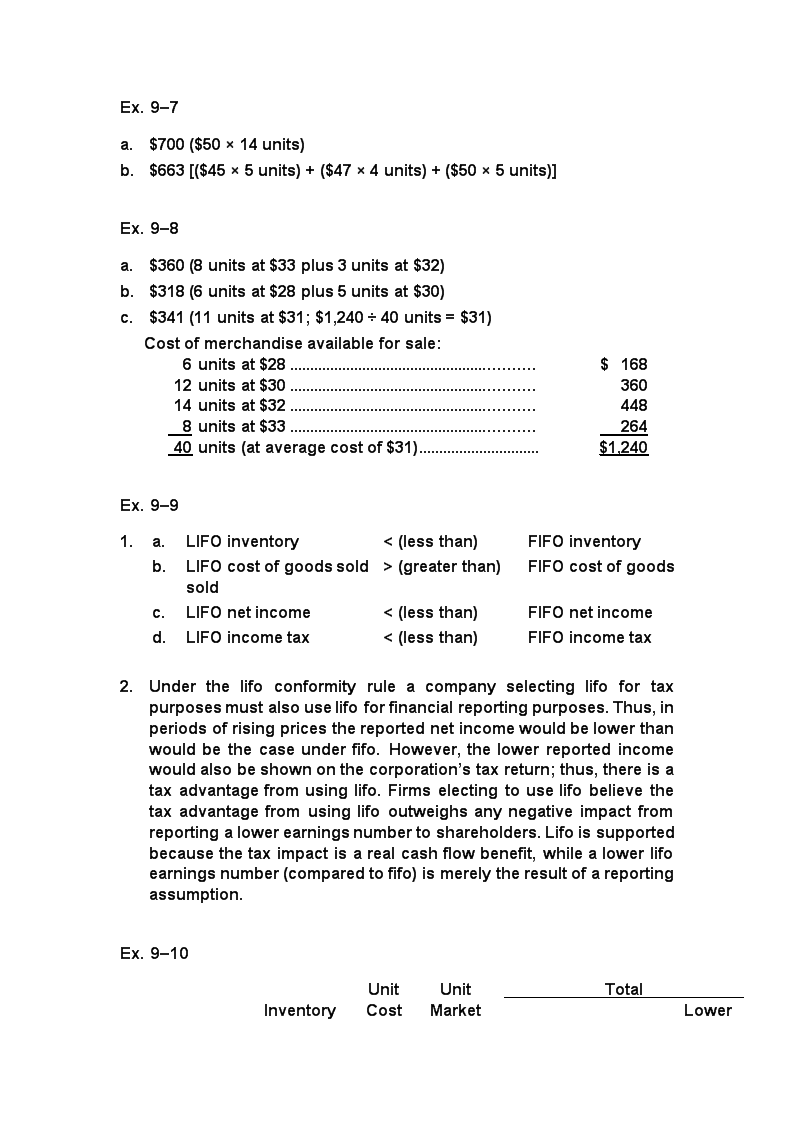

Ex.9–7a.$700($50×14units)b.$663[($45×5units)+($47×4units)+($50×5units)]Ex.9–8a.$360(8unitsat$33plus3unitsat$32)b.$318(6unitsat$28plus5unitsat$30)c.$341(11unitsat$31;$1,240÷40units=$31)Costofmerchandiseavailableforsale:6unitsat$28$16812unitsat$3036014unitsat$324488unitsat$3326440units(ataveragecostof$31)$1,240Ex.9–91.a.LIFOinventory<(lessthan)FIFOinventoryb.LIFOcostofgoodssold>(greaterthan)FIFOcostofgoodssoldc.LIFOnetincome<(lessthan)FIFOnetincomed.LIFOincometax<(lessthan)FIFOincometax2.Underthelifoconformityruleacompanyselectinglifofortaxpurposesmustalsouselifoforfinancialreportingpurposes.Thus,inperiodsofrisingpricesthereportednetincomewouldbelowerthanwouldbethecaseunderfifo.However,thelowerreportedincomewouldalsobeshownonthecorporation’staxreturn;thus,thereisataxadvantagefromusinglifo.Firmselectingtouselifobelievethetaxadvantagefromusinglifooutweighsanynegativeimpactfromreportingalowerearningsnumbertoshareholders.Lifoissupportedbecausethetaximpactisarealcashflowbenefit,whilealowerlifoearningsnumber(comparedtofifo)ismerelytheresultofareportingassumption.Ex.9–10UnitUnitTotalInventoryCostMarketLower

CommodityQuantityPricePriceCostMarketofCorMM768$150$160$1,200$1,280$1,200T532075701,5001,4001,400A19102752602,7502,6002,600J81155040750600600K10251011052,5252,6252,525Total$8,725$8,505$8,325Ex.9–11ThemerchandiseinventorywouldappearintheCurrentAssetssection,asfollows:Merchandiseinventory—atlowerofcost,fifo,ormarket$8,325Alternatively,thedetailsofthemethodofdeterminingcostandthemethodofvaluationcouldbepresentedinanote.Ex.9–12CostRetailMerchandiseinventory,June1$160,000$180,000PurchasesinJune(net)680,0001,020,000Merchandiseavailableforsale$840,000$1,200,000Ratioofcosttoretailprice:SalesforJune(net)875,000Merchandiseinventory,June30,atretailprice$325,000Merchandiseinventory,June30,atestimatedcost($325,000×70%)$227,500Ex.9–13a.Merchandiseinventory,Jan.1$180,000Purchases(net),Jan.1–May17750,000Merchandiseavailableforsale$930,000Sales(net),Jan.1–May17$1,250,000Lessestimatedgrossprofit($1,250,000×35%)437,500

Estimatedcostofmerchandisesold812,500Estimatedmerchandiseinventory,May17$117,500b.Thegrossprofitmethodisusefulforestimatinginventoriesformonthlyorquarterlyfinancialstatements.Itisalsousefulinestimatingthecostofmerchandisedestroyedbyfireorotherdisasters.Ex.9–14a.Apple:147.8{$4,139,000,000÷[($45,000,000+$11,000,000)÷2]}AmericanGreetings:3.1{$881,771,000÷[($278,807,000+$290,804,000)÷2]}b.Lower.AlthoughAmericanGreetings’businessisseasonalinnature,withmostofitsrevenuegeneratedduringthemajorholidays,muchofitsnonholidayinventorymayturnoververyslowly.Apple,ontheotherhand,turnsitsinventoryoververyfastbecauseitmaintainsalowinventory,whichallowsittorespondquicklytocustomerneeds.Additionally,Apple’scomputerproductscanquicklybecomeobsolete,soitcannotriskbuildinglargeinventories.Ex.9–15a.Numberofdays’salesininventory=Albertson’s,=43daysKroger,=40daysSafeway,=42daysInventoryturnover=

Albertson’s,=8.2Kroger,=9.1Safeway,=8.9b.Thenumberofdays’saleininventoryandinventoryturnoverratiosareconsistent.Albertson’shasslightlymoreinventorythandoesSafeway.Krogerhasrelativelylessinventory(2–3days)thandoesAlbertson’sandSafeway.

Ex.9–21Concludedc.IfAlbertson’smatchedKroger’sdays’salesininventory,thenitshypotheticalendinginventorywouldbedeterminedasfollows,Numberofdays’salesininventory=40days=X=40´($25,242/365)X=$2,766Thus,theadditionalcashflowthatwouldhavebeengeneratedisthedifferencebetweentheactualendinginventoryandthehypotheticalendinginventory,asfollows:Actualendinginventory$2,973millionHypotheticalendinginventory2,766Positivecashflowpotential$207millionThatis,alowerendinginventoryamountwouldhaverequiredlesscashthanactuallywasrequired.'

您可能关注的文档

- 机电传动第5章习题答案.doc

- 机电传动课手习题第2章答案.doc

- 杨谦主编《水法规与行政执法》 - 课后问答题全部答案.doc

- 校园网-中国近代史纲要课后思考题参考答案[1].doc

- 核舟记练习题及答案.doc

- 桃花源记练习题完整练习及答案.docx

- 梁小民《西方经济学 第二版》第七章课后习题答案.doc

- 植物学练习题及答案.docx

- 概率论与数理统计课后习题答案.doc

- 毕晓方改编+《财务会计》的课后习题答案第二章习题答案.doc

- 毛中特上课后题答案新.doc

- 毛概1-8章习题答案.doc

- 毛概8-15章课后习题答案.doc

- 毛概一答案.doc

- 毛概三课后答案.doc

- 毛概习题及答案.doc

- 毛概习题及答案一二三章 (1).docx

- 毛概习题训练(有答案)(1).doc